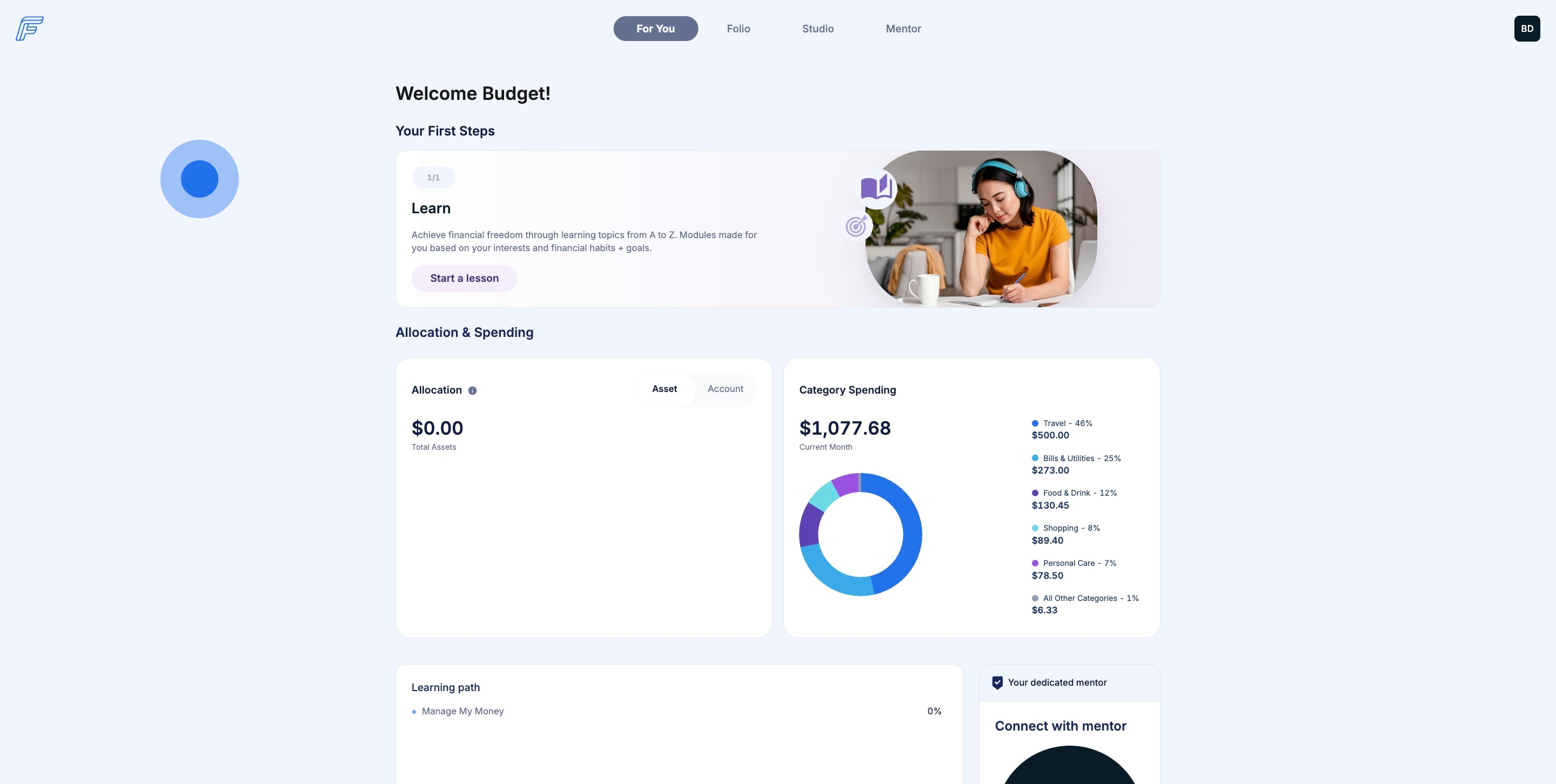

How do I use the Budget tool in the Fruition Folio?

Use the Budget tool to create an Auto or Custom Budget and get your finances in order.

1. Ready to get your finances in order? Our new Budget tool is here to make your weekly and monthly spending make sense and get in line with your savings goals. Let's get started!

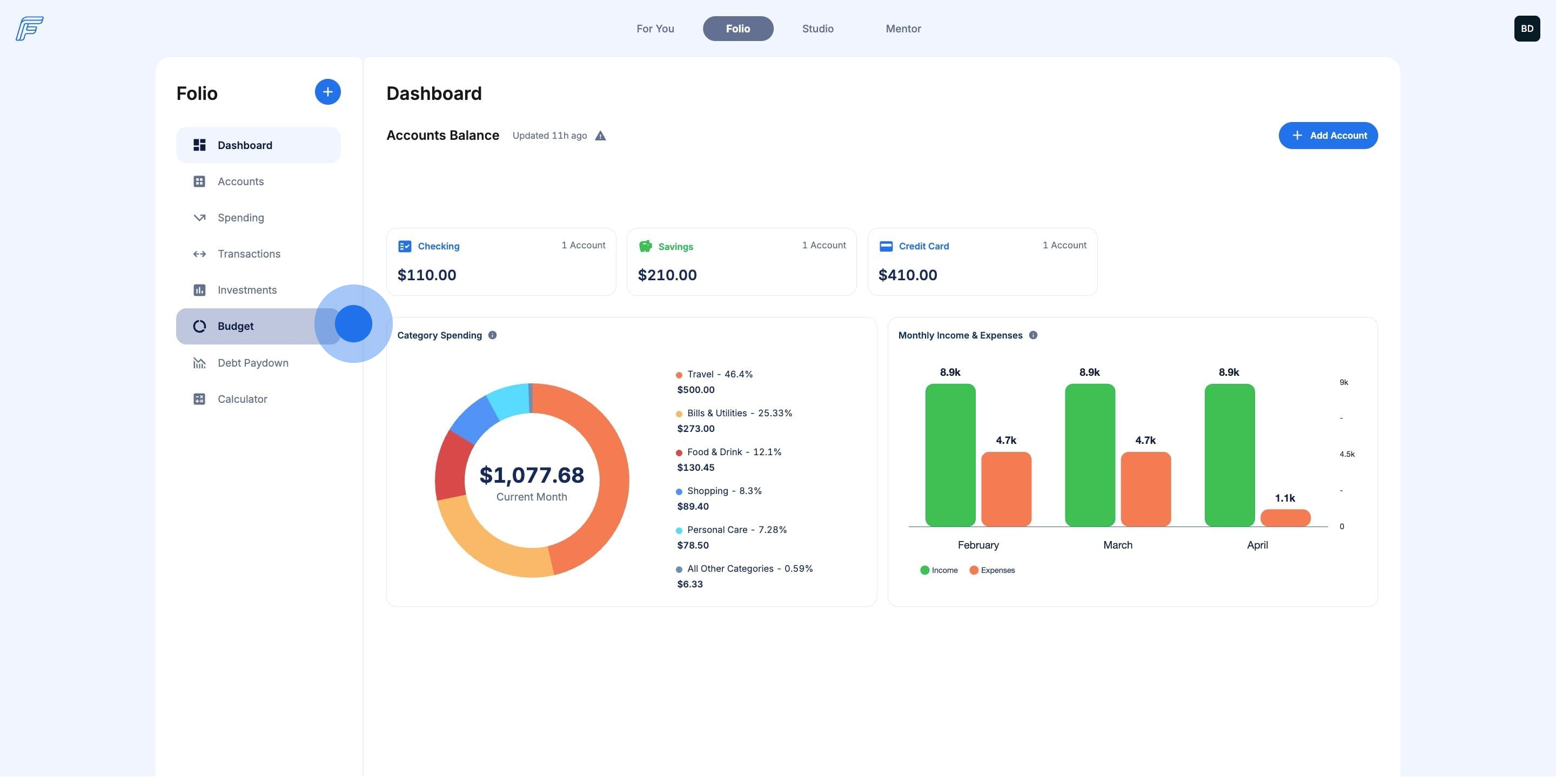

2. The Budget tool lives inside your Fruition Folio.

3. From the Folio dashboard, click on Budget in the left hand menu.

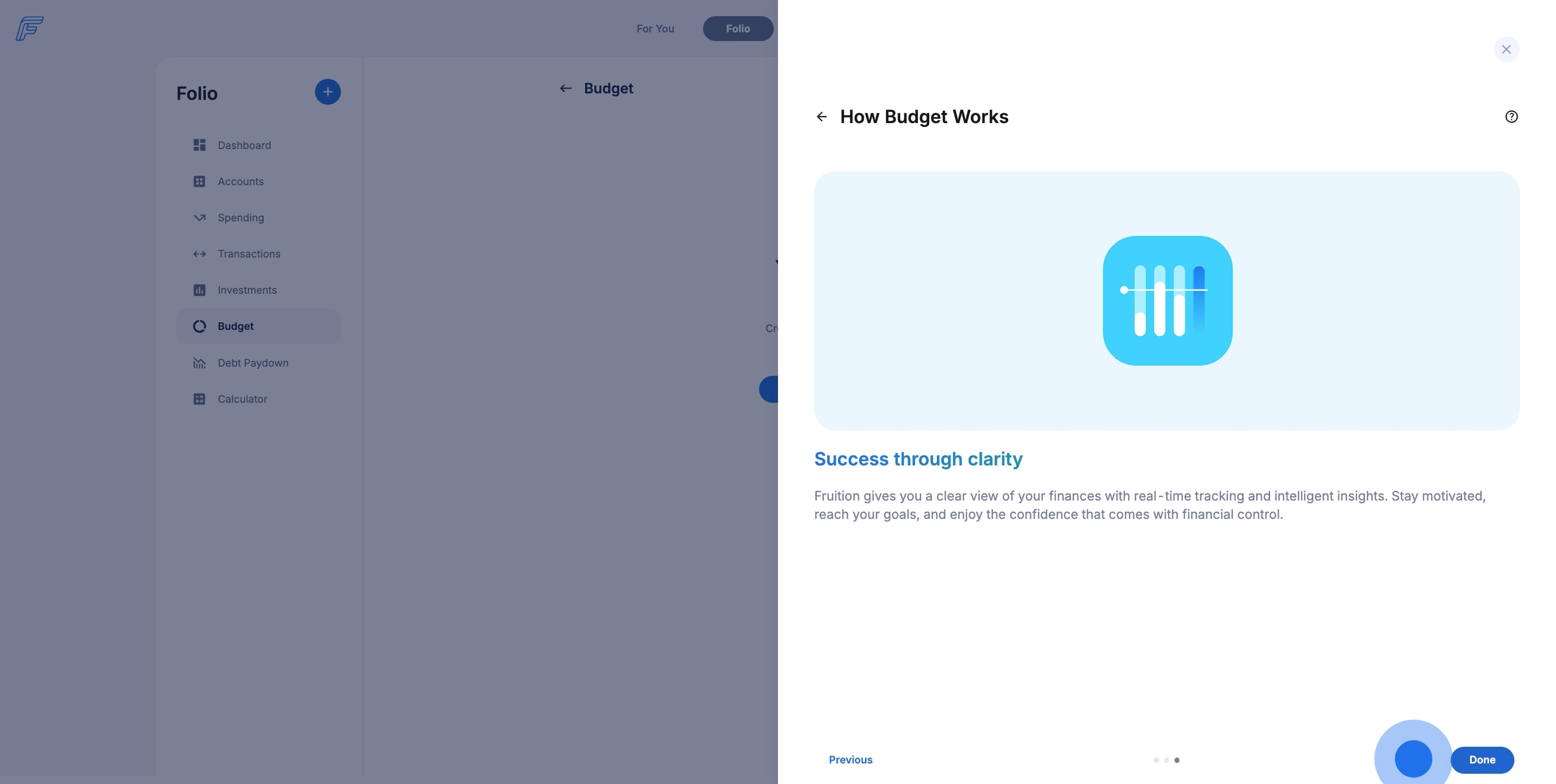

4. We're ready to build! But first - how are budgets at Fruition made? Let's see.

5. Here's a quick breakdown on how we think about budgeting at Fruition.

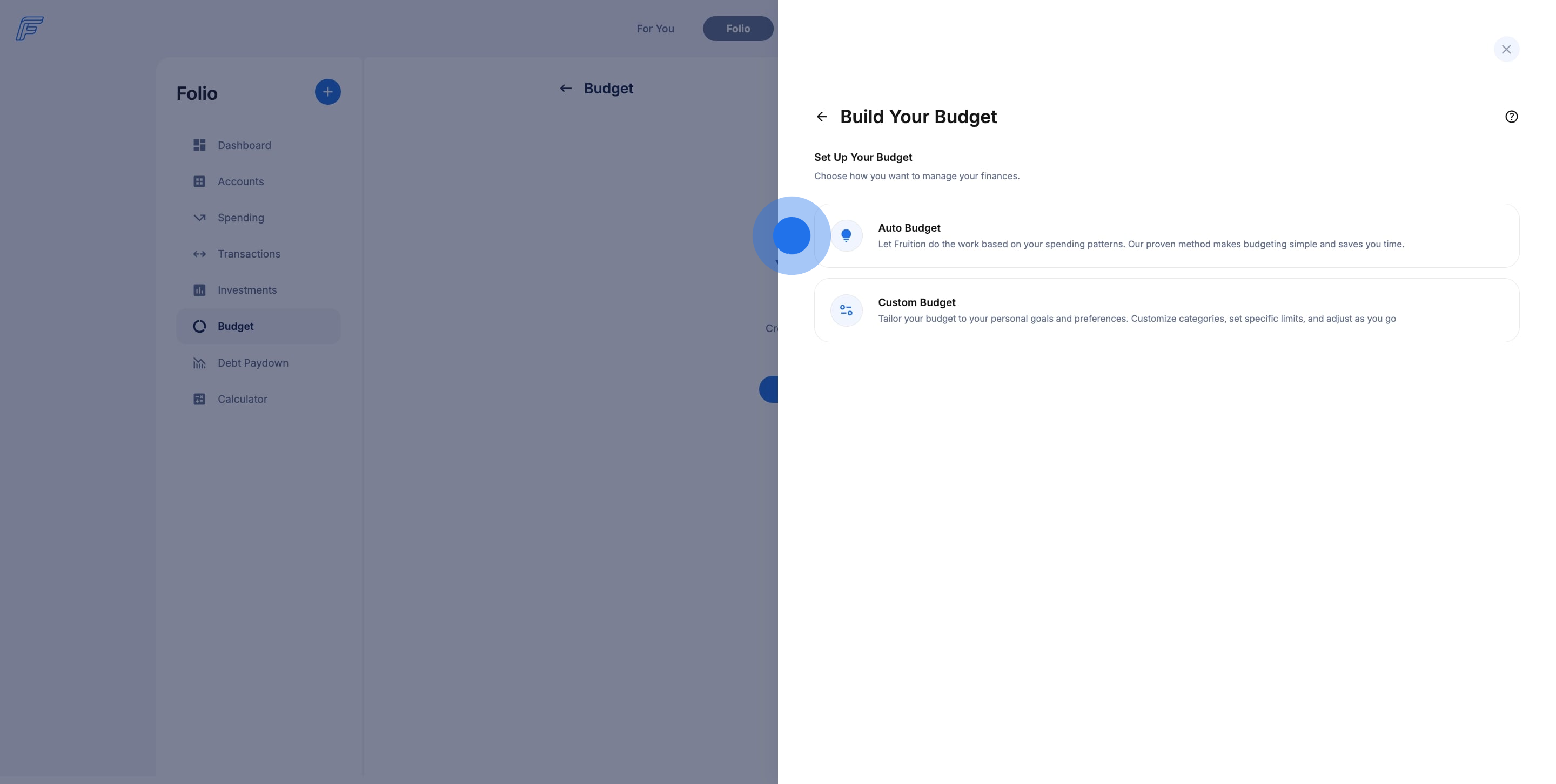

6. Let us do the work for you with Auto Budget. We use the 50/30/20 rule to build a zero-based budget for you using your spending habits. You need 3 months of transactions from connected accounts in your Fruition Folio to build an Auto Budget.

7. Or build a Custom Budget based on your wants, needs, and savings goals!

8. Let's get started with Auto Budget!

9. Click on Build your Budget to begin.

10. Today, we're going to build an Auto Budget.

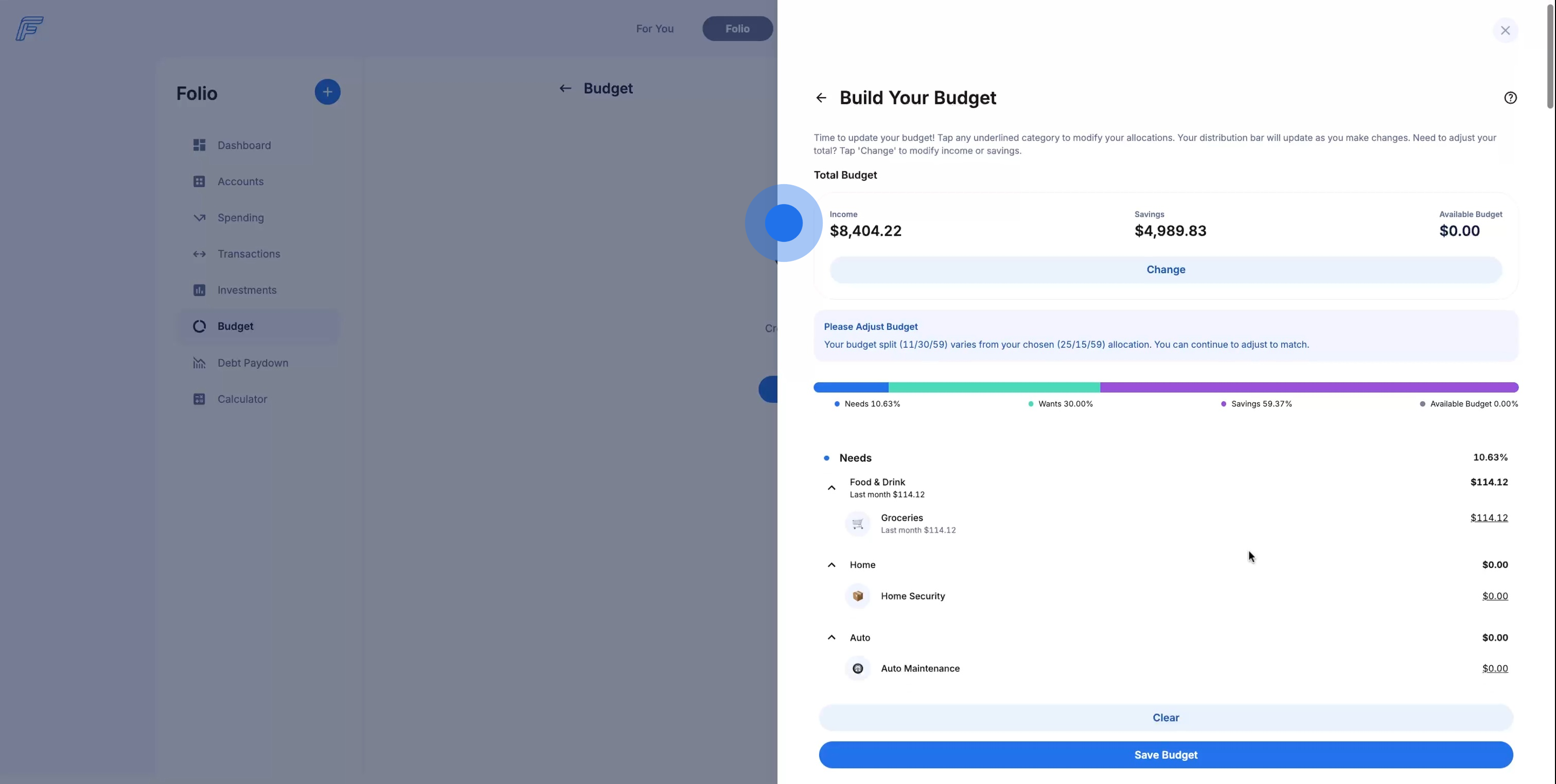

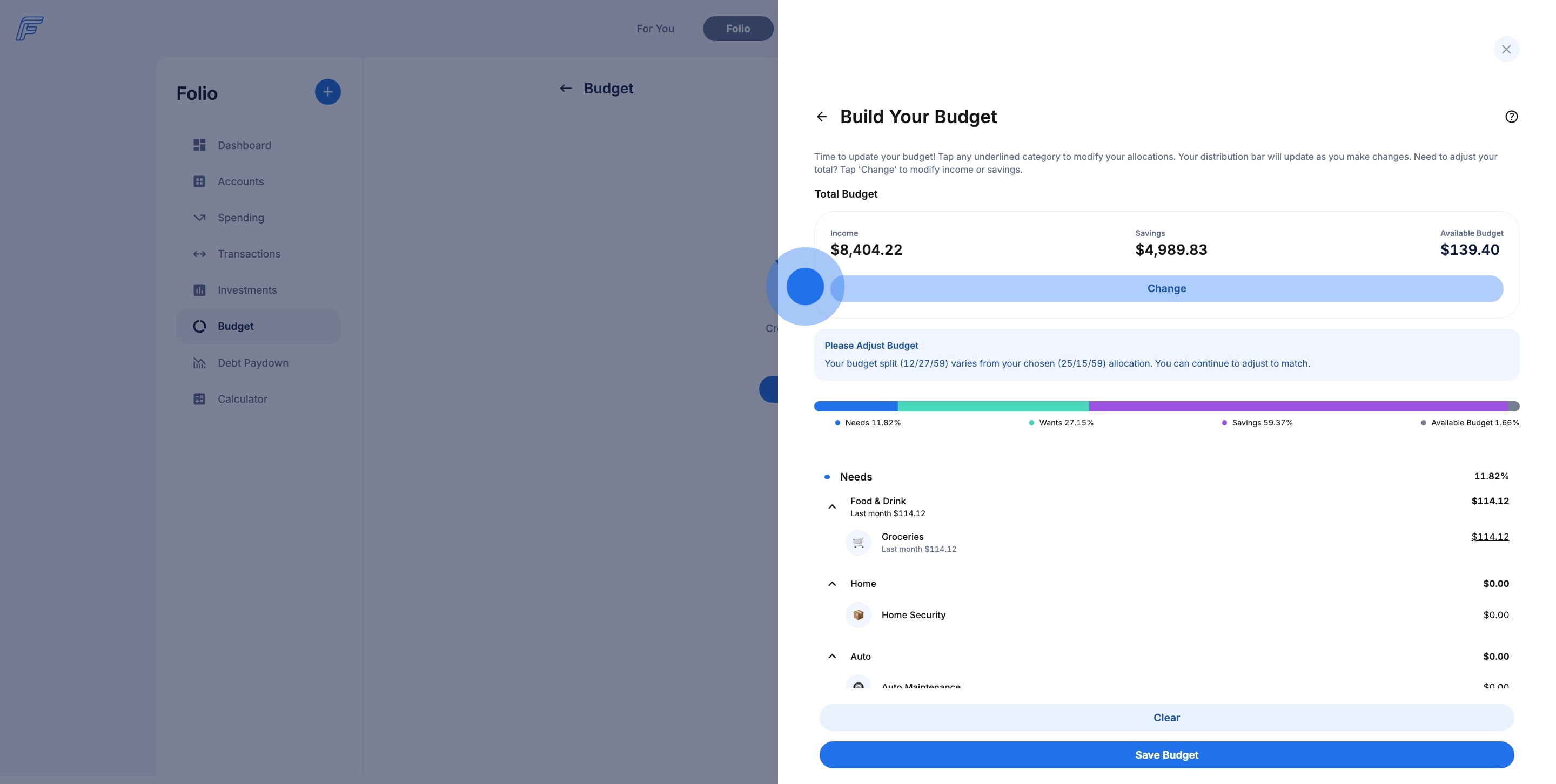

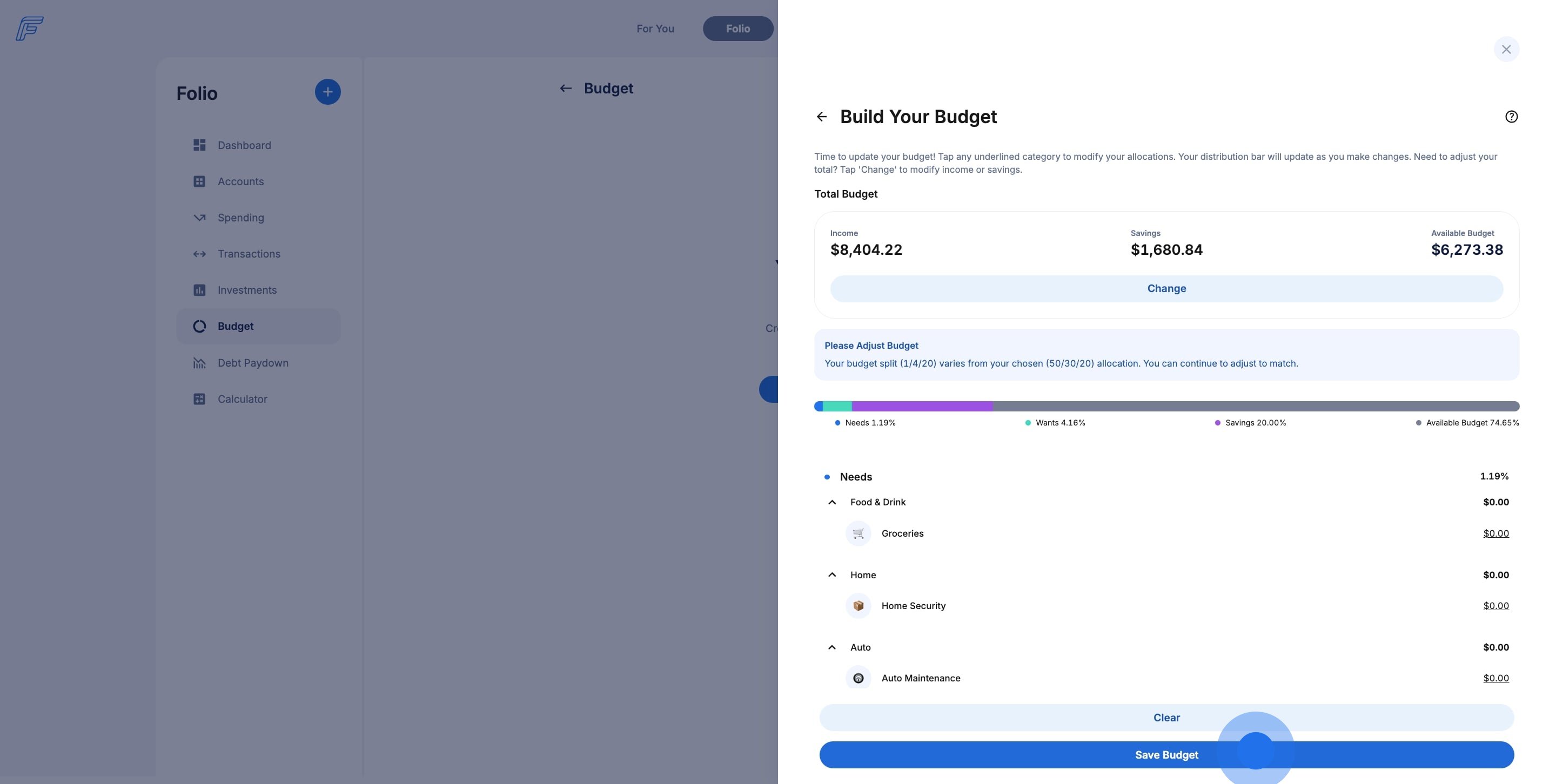

11. 🎉 Ta-da! Meet your new Auto Budget!

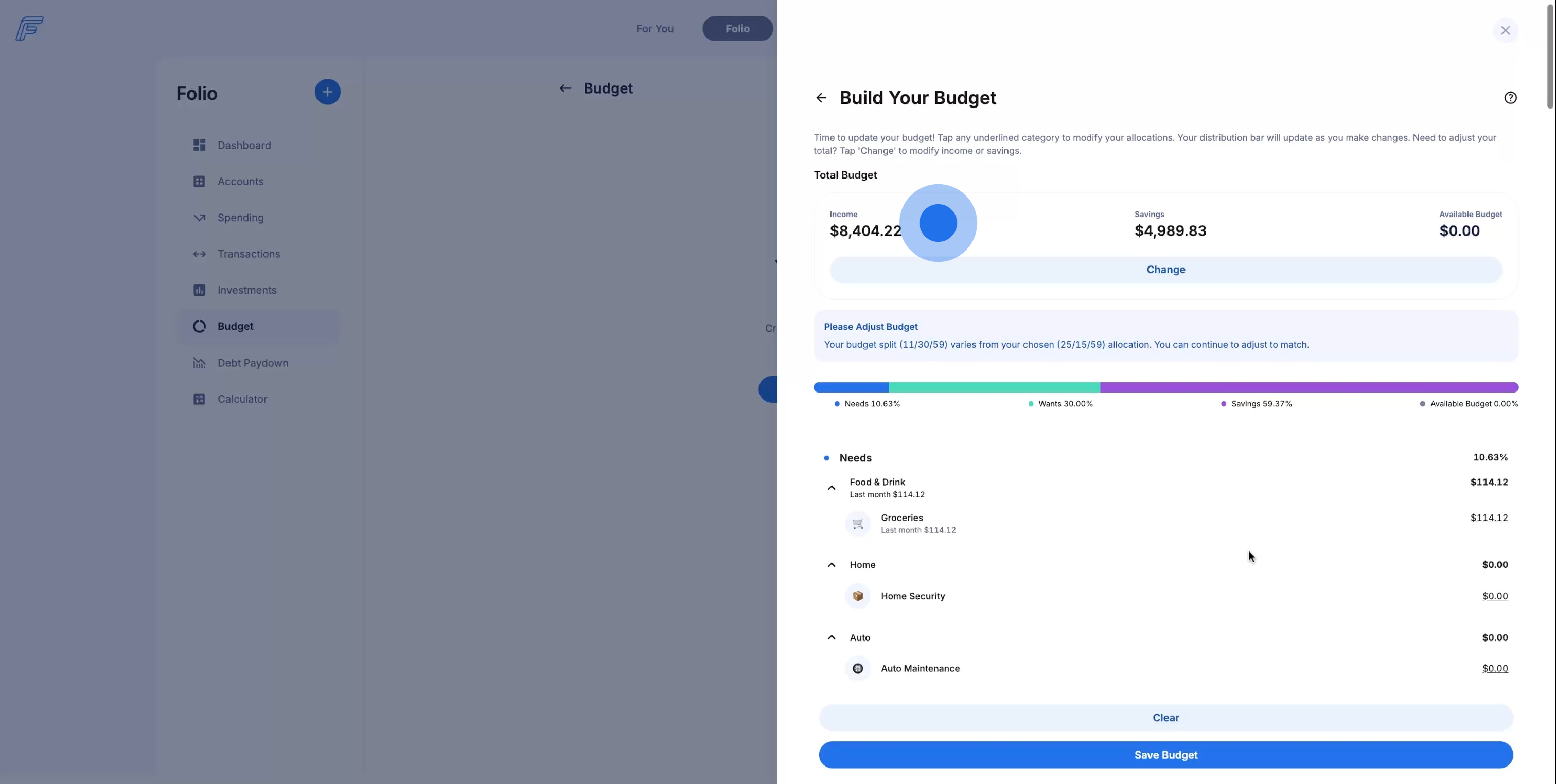

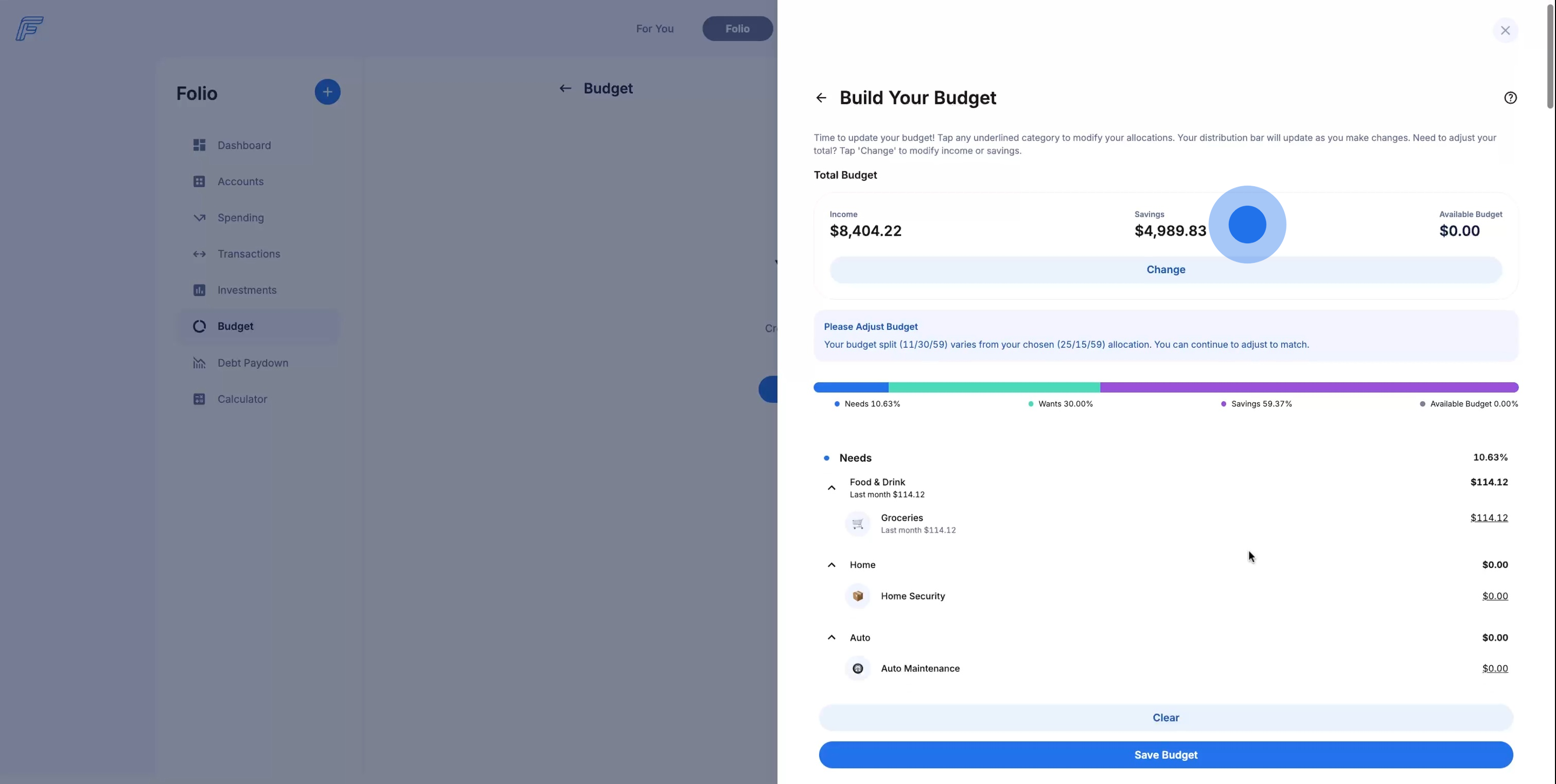

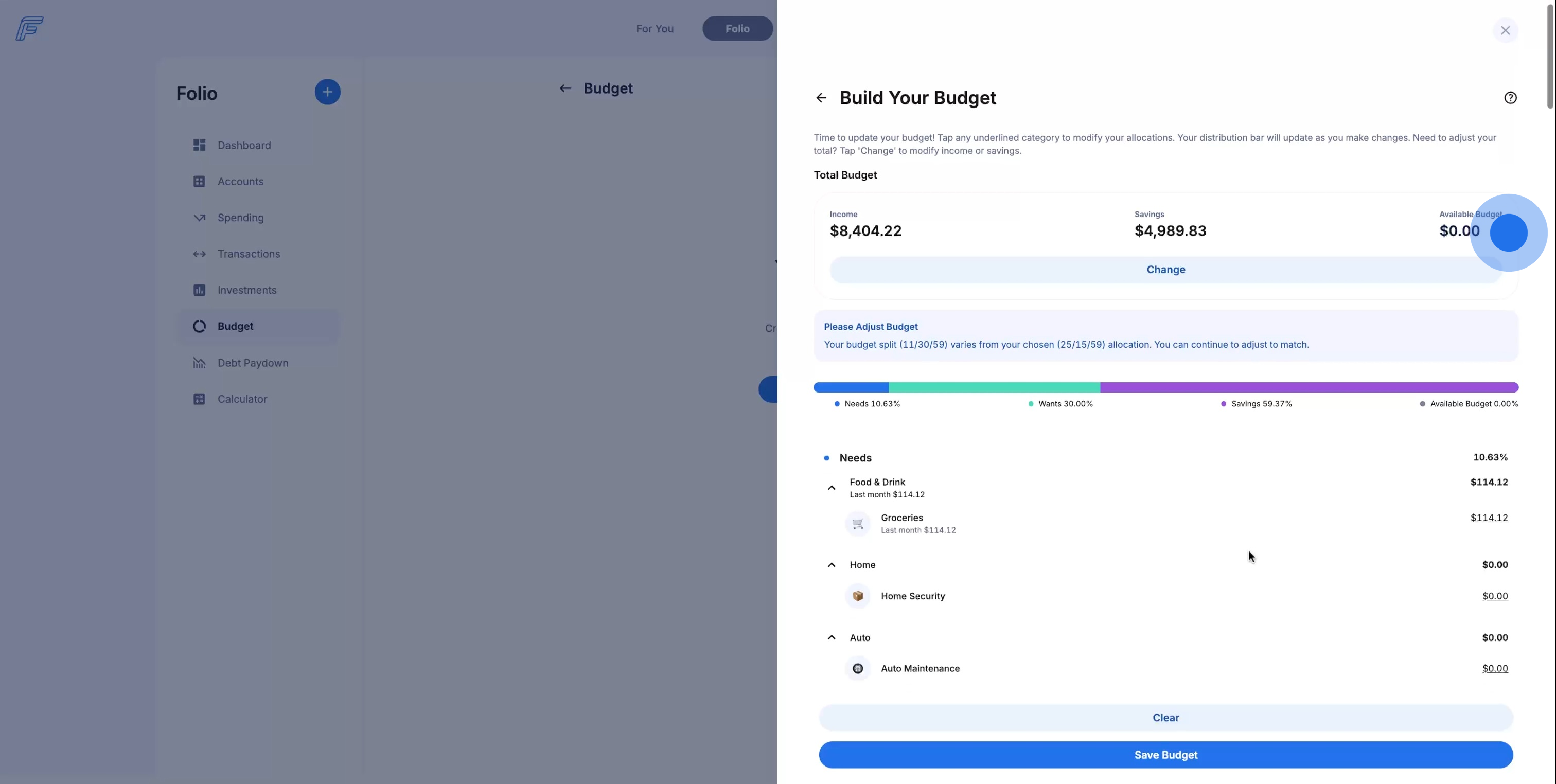

12. All transactions categorized as Income are summed up to display your monthly total income.

13. 💰 The dollar amount displayed for Savings is as close to 20% of your monthly income given your spending and transactions.

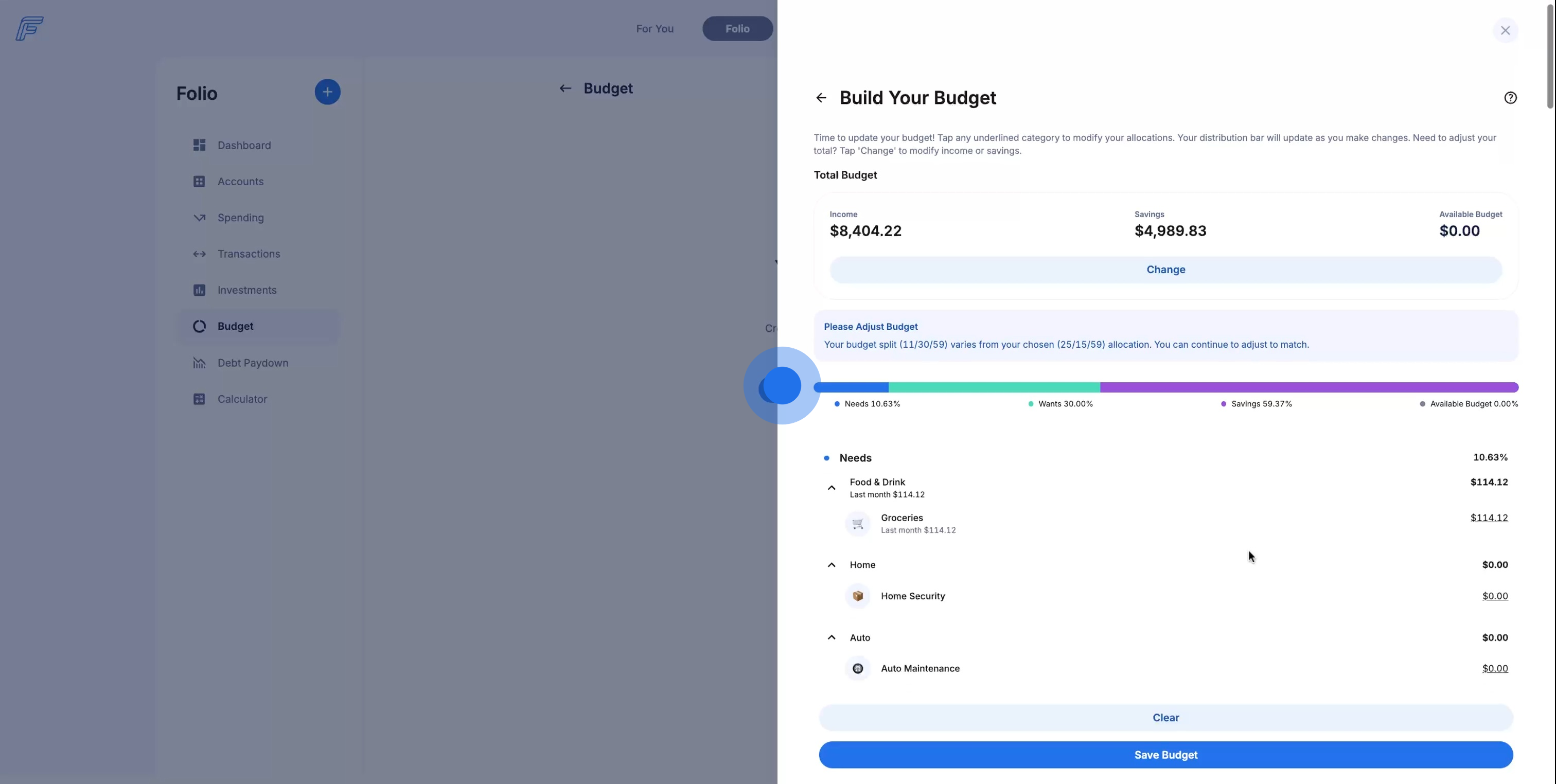

14. The total dollar amount displayed in Available Budget is what you have left over or what you've over budgeted. Auto Budget aims to have a $0.00 available balance at the end of the month.

15. The Budget Bar automatically adjusts when you adjust the dollar amounts in subcategories of your needs, wants, and savings.

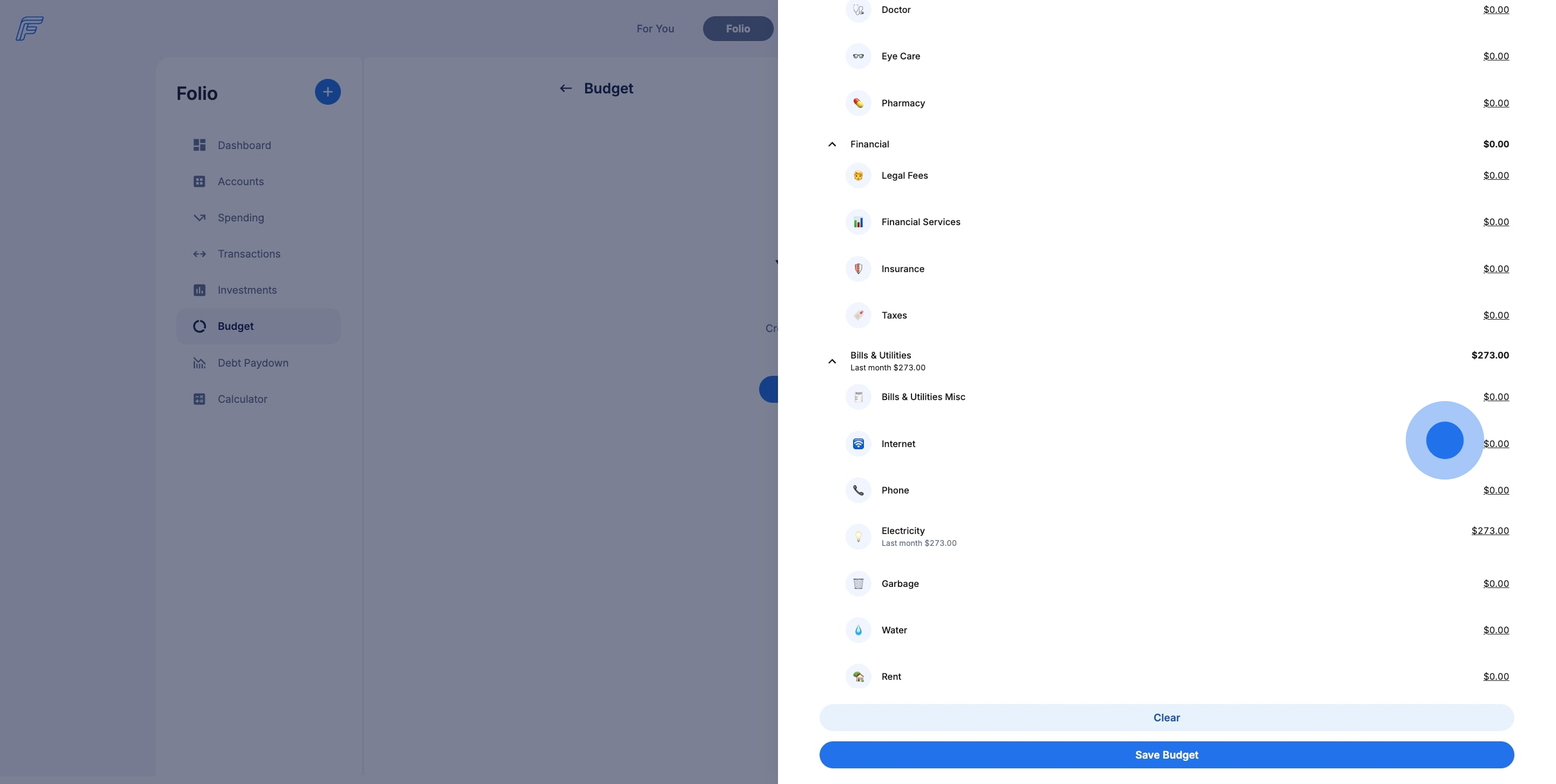

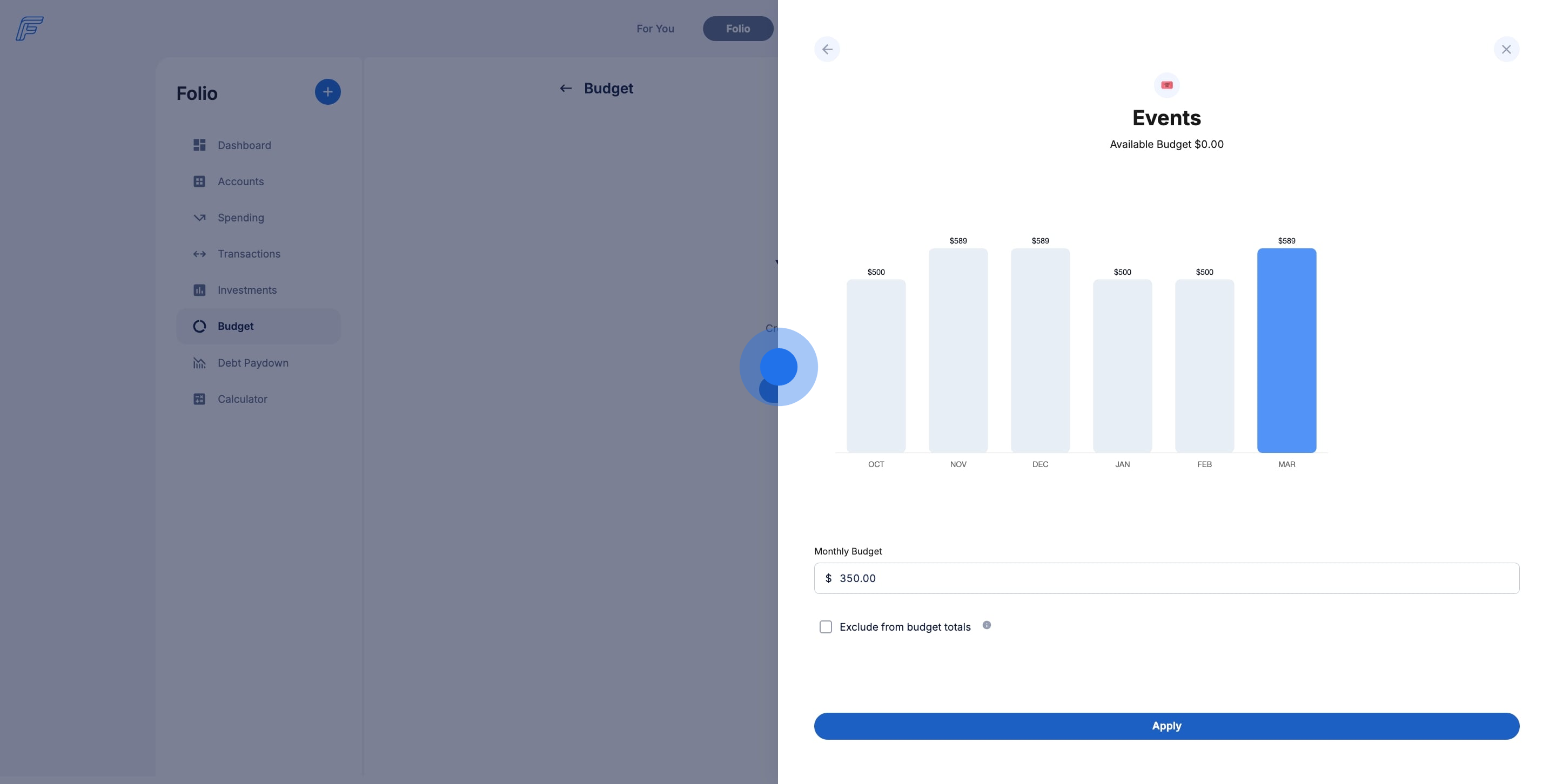

16. Turn your Auto Budget into a Custom Budget when you click the underlined subcategory total to edit any monthly budget line item.

17. See historic spending in each subcategory and adjust your monthly budget accordingly. Click Apply to save your changes.

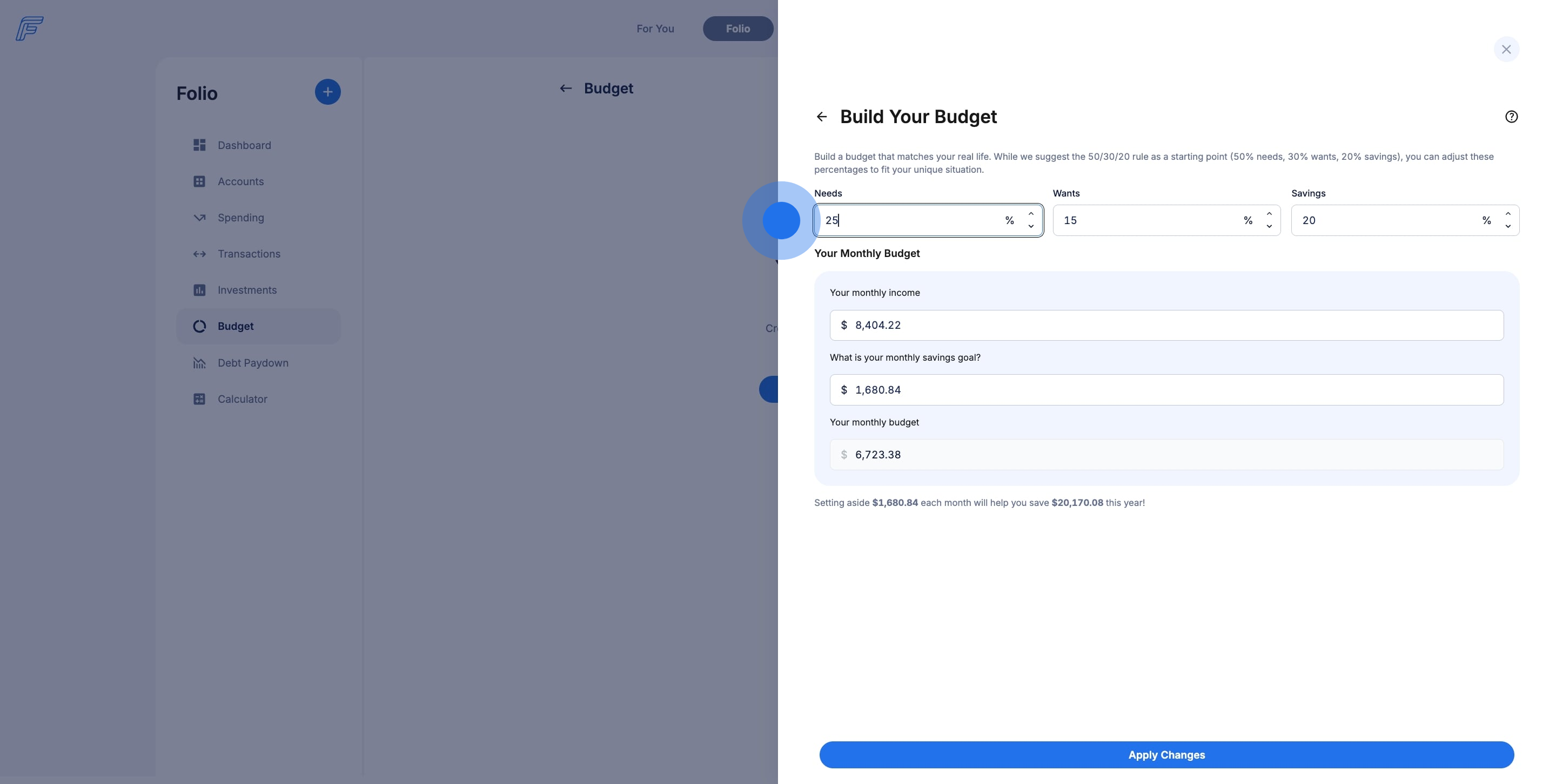

18. Click Change to edit your overall budget numbers or change your needs, wants, and savings percentages.

19. Your budget is yours. We suggest a 50% needs, 30% wants, 20% savings split but you can make it your own. Adjust your income, savings goal, or percentages at any time.

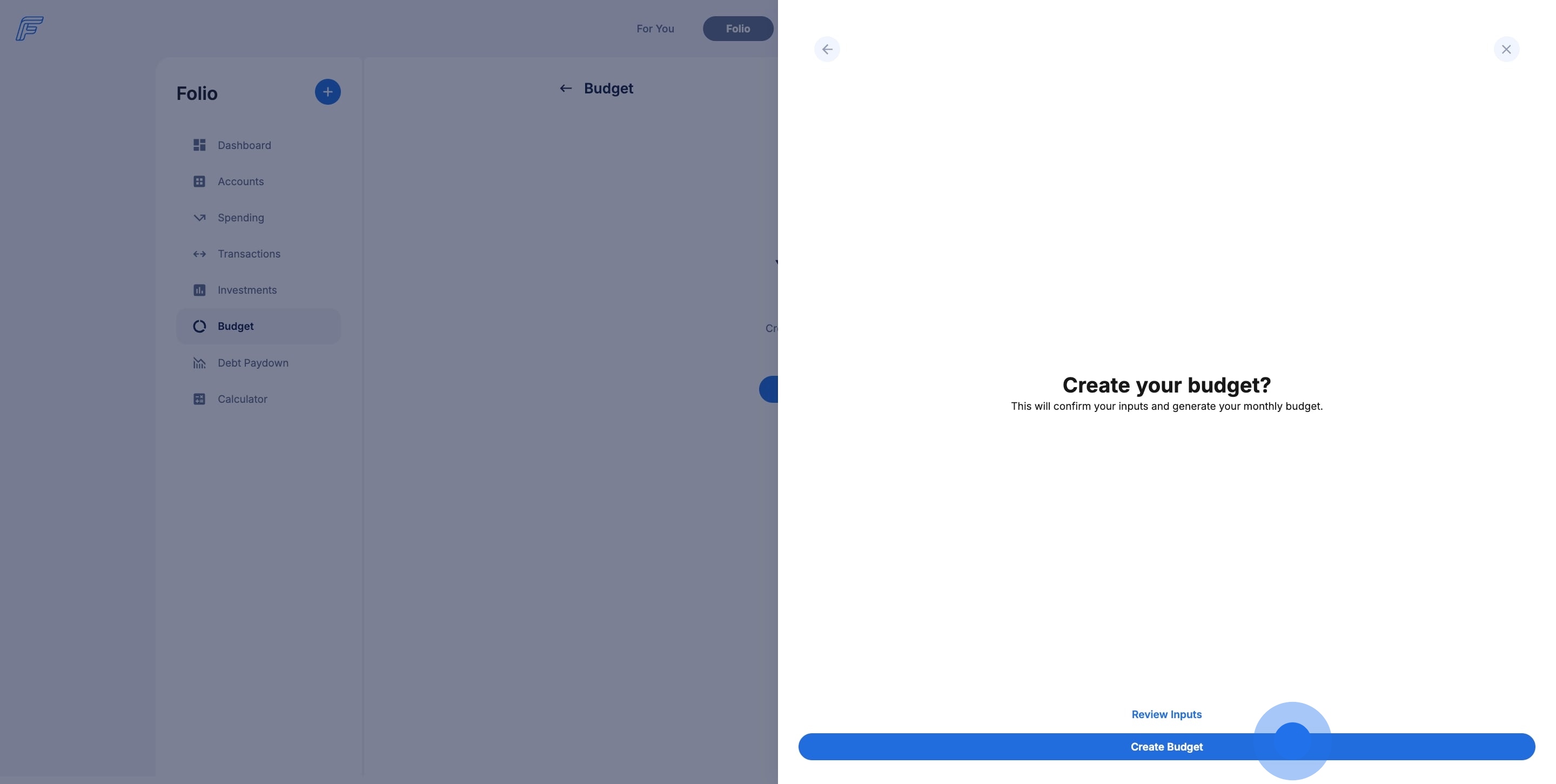

20. Once you've built your Budget, save it to refer back to it at any time.

21. Confirm and create your budget.

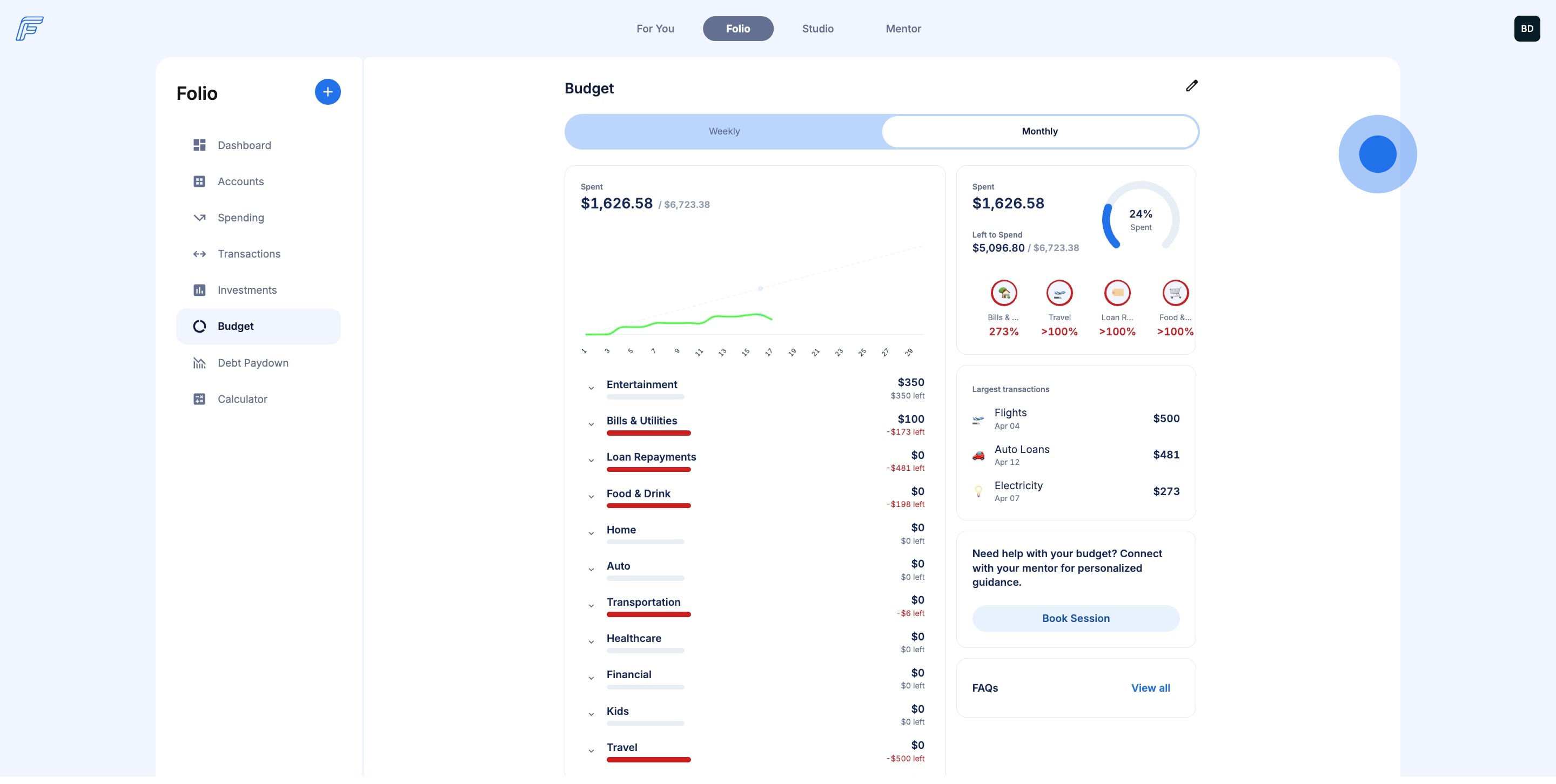

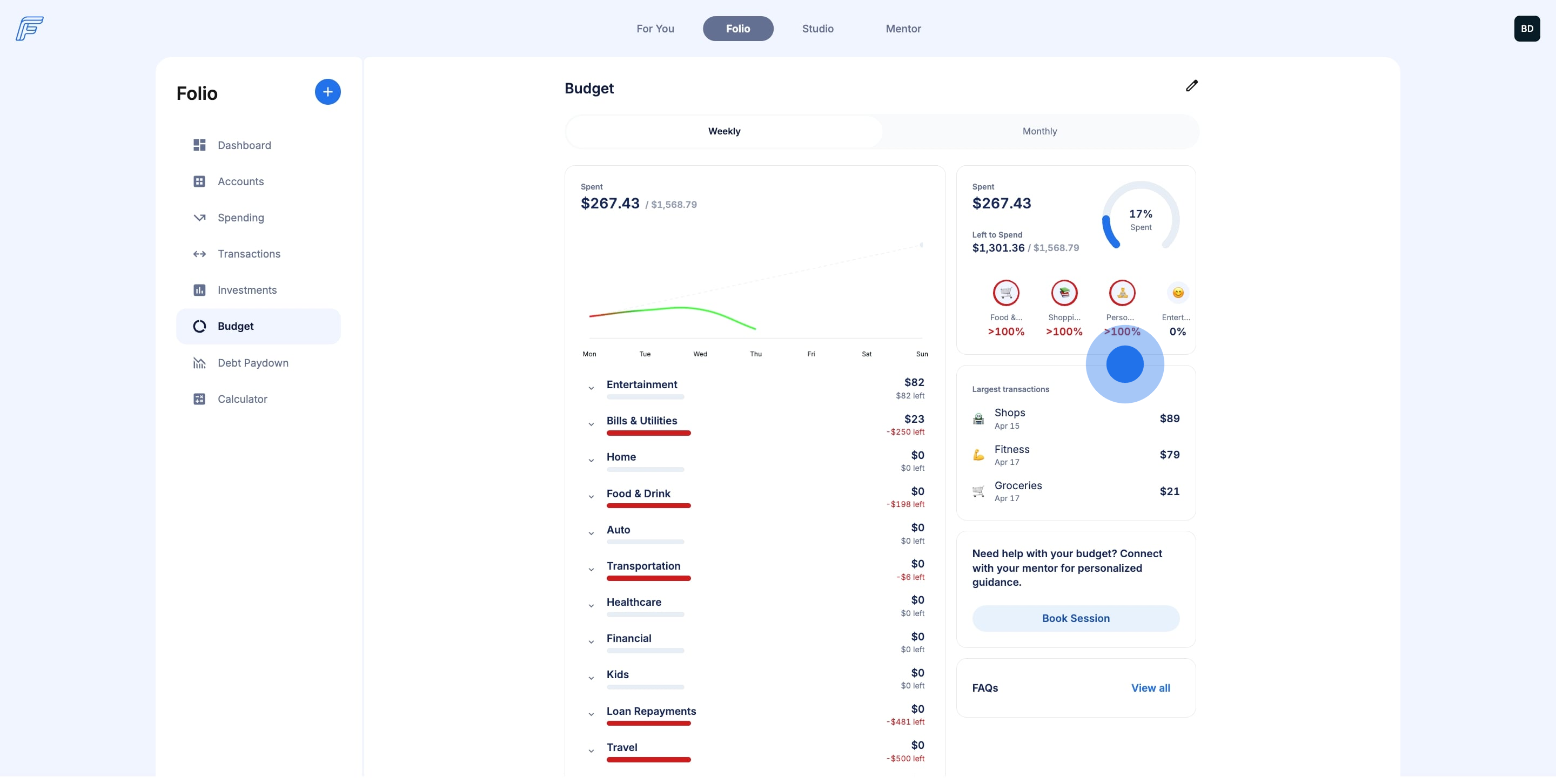

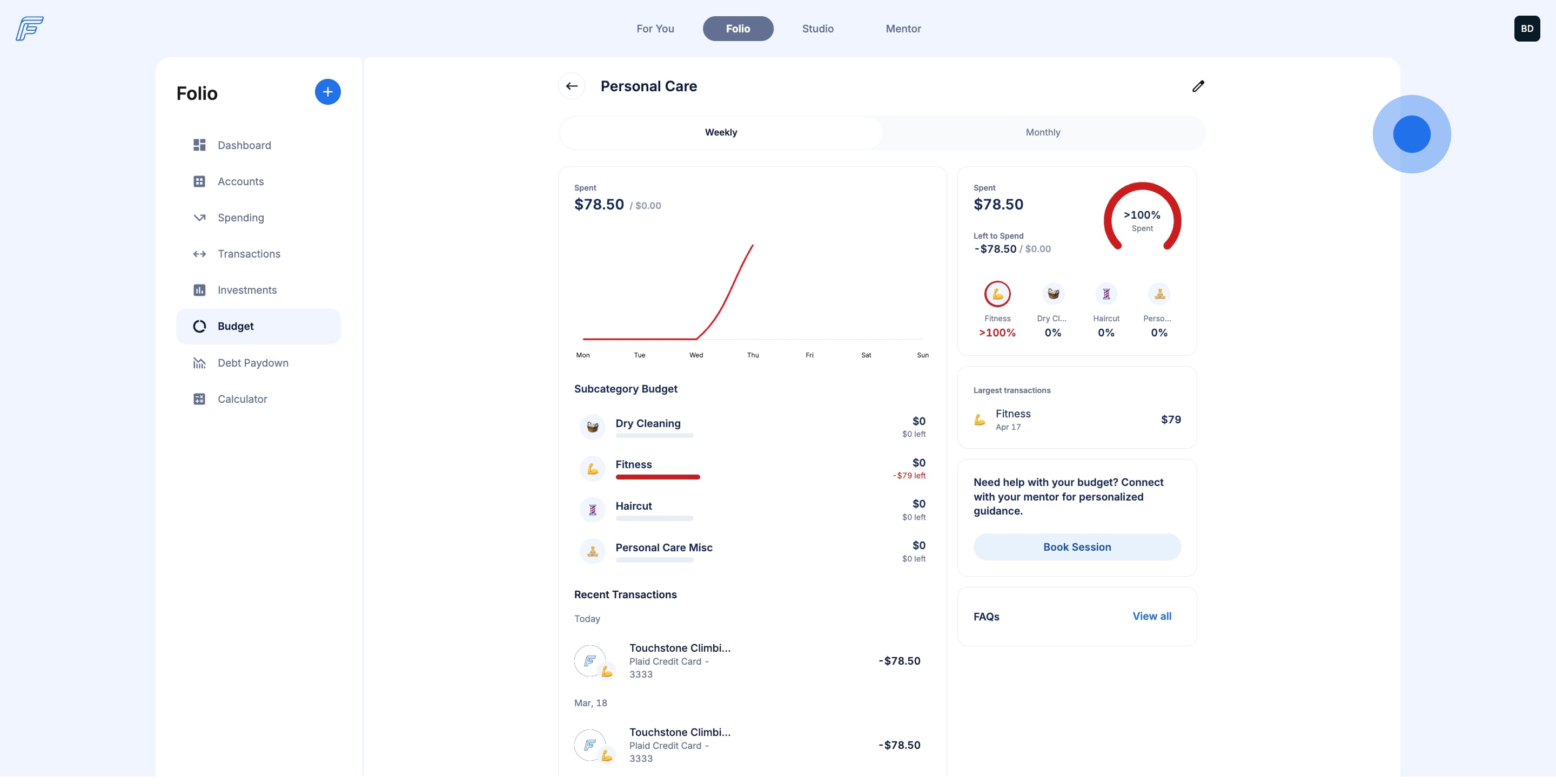

22. Once you've built your Budget, track your category and subcategory spending monthly or weekly. Gain insights into where you've overspent and where you've mastered your money.

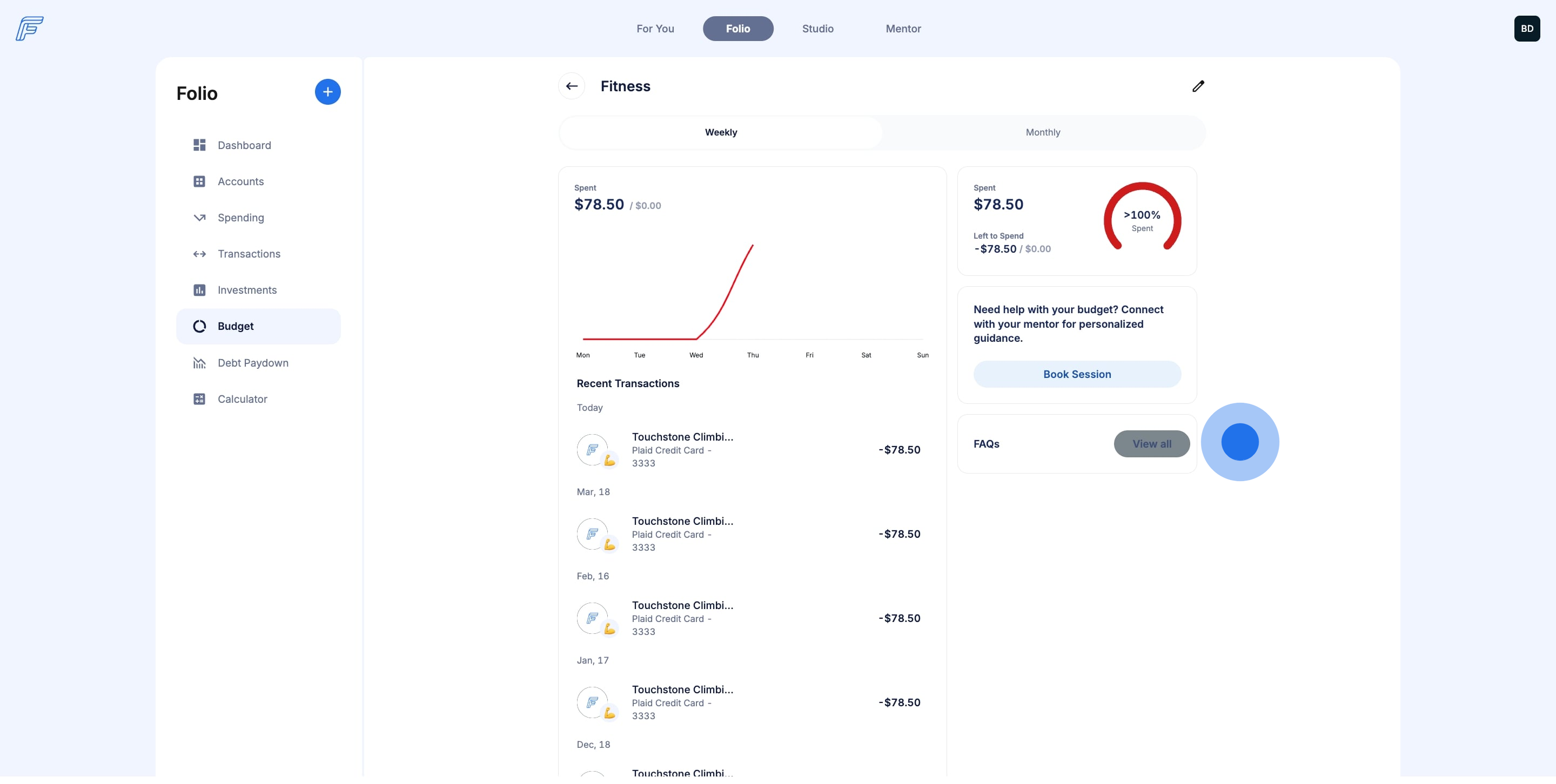

23. Click a category emoji to see a breakdown of subcategory spending.

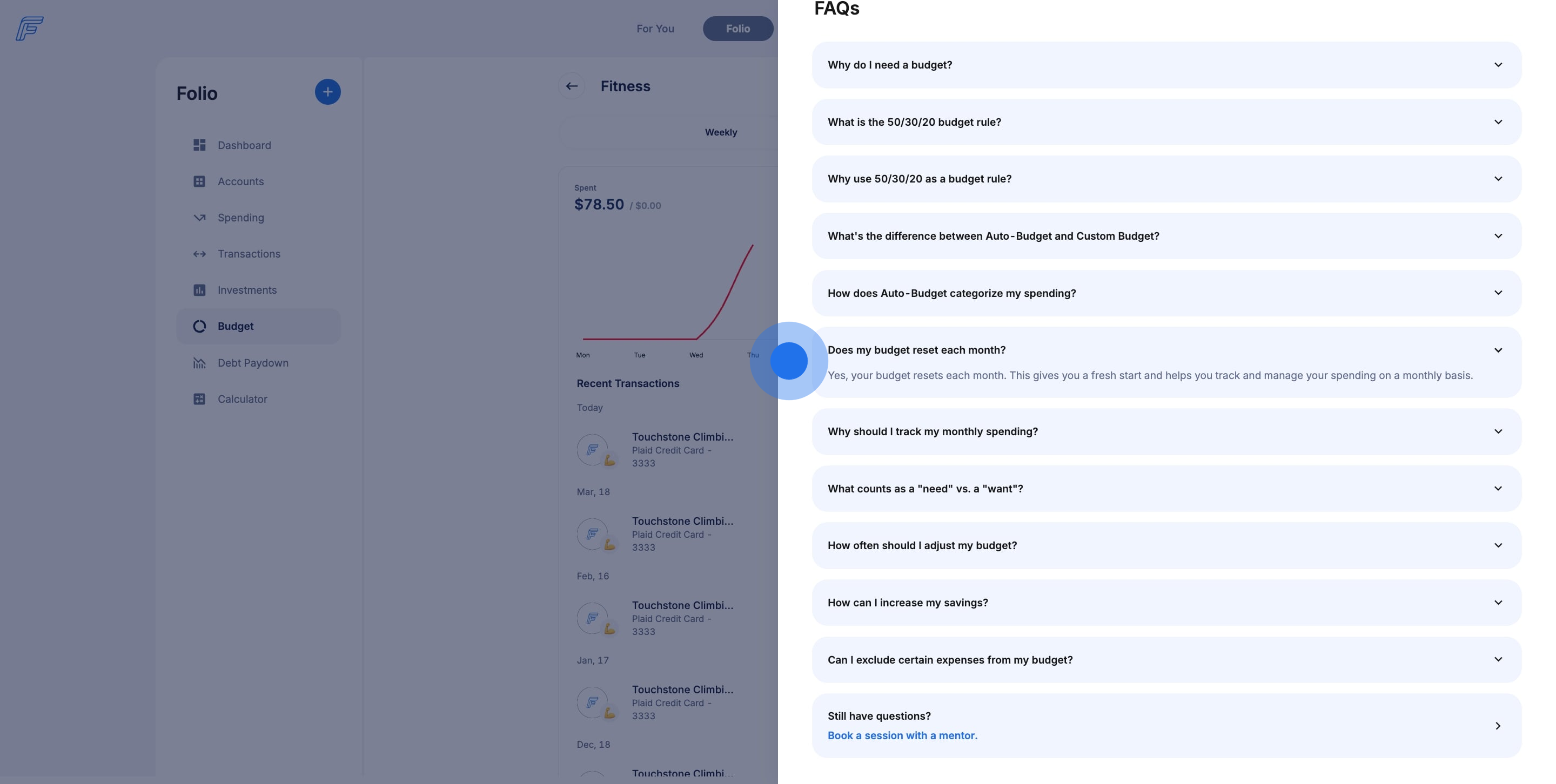

24. From the category view, understand your spending by subcategory. See transaction details and update your categories to match your spending.

25. Find answers to Budget questions in the FAQs.

26. Find the answers you need quickly. Need more help? Book a 20-minute or 50-minute Mentor session.